Pursuit of Commercial Prospects

The Upstream Development and Production department’s mandate is premised on the acquisition of international oil producing assets, and monitoring NAMCOR’s share of participation in the Namibian discoveries. This is in line with NAMCOR’s strategy of securing long-term revenue for the company while transferring operatorship competencies and relevant technologies.

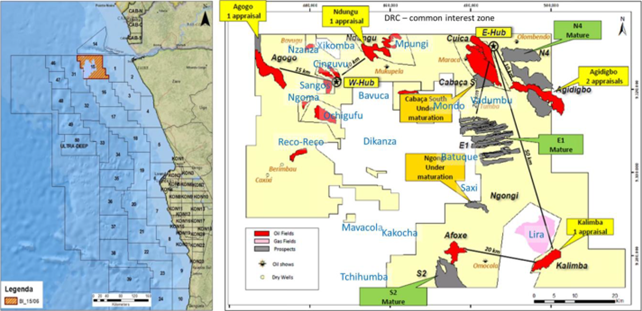

The company has made substantial progress in its asset acquisition efforts, with the ongoing participation in the Sonangol Divestment process, where NAMCOR and its partners successfully bid for Blocks 15/06, 23 & 27. On 12 April 2022 NAMCOR and its partners entered into the Sales and Purchase Agreement (SPA) with Sonangol P&P to purchase a 10% working interest in Block 15/06, 40 % working interest in Block 23 (with operatorship), and 35% working interest in Block 27.

An independent technical and commercial review of Block 15/06 was conducted by TRACS International Limited to identify projects potentially classified as reserves following the SPE PRMS guidelines for classification of reserves and resources. TRACS review concluded that the 10% working interest in Block 15/06 has equivalent remaining technical recoverable volumes of ca.55 million barrels of oil as of April 2022, with further net in-place resources in field upsides, discoveries, and prospect pools of ca.70, 45, and 290 million barrels respectively (unrisked). The review has not identified any potential red flags, technical or commercial, relating to the acquisition of Block 15/06. The finalization of the acquisition of all the block is subject to customary conditions and approvals, with completion expected by end 2023.

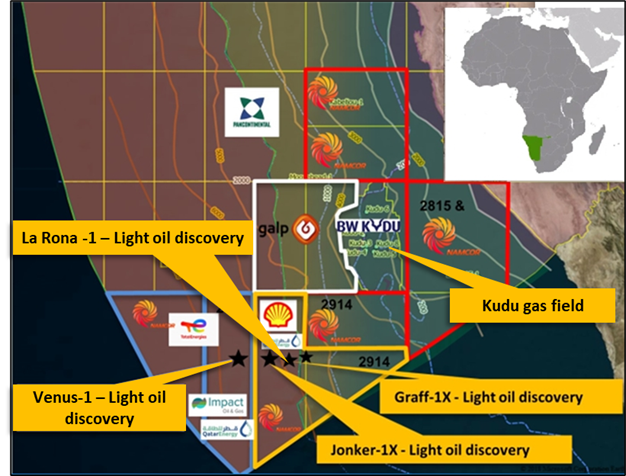

Kudu Gas Project

NAMCOR and its partner and operator of the Kudu Gas project BW Kudu are busy working on maturing the development concept for the project, which is a fast tracked two phased gas-to-power solution, meant to produce electricity for domestic consumption as well as export within the region. The current project shareholding is as follows:

- BW Energy 95%

- NAMCOR 5% carry with a 5% back in right

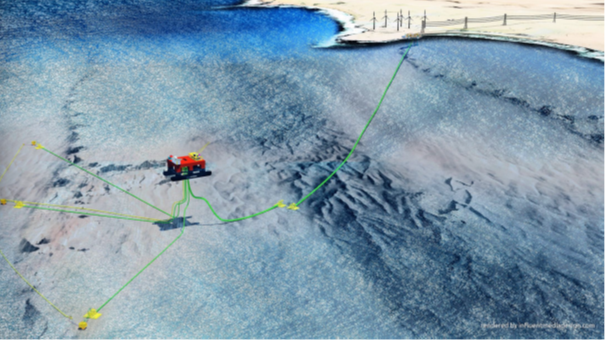

The joint venture is currently preparing for the front-end engineering design (FEED) activities towards developing the Kudu Gas project. The development concept being matured is a fast tracked two phased gas-to-power solution, that consists of 3 highly deviated wells tied back via subsea flexible flowline and control umbilical to an Offshore Floating Production Facility (FPF). This FPF will be connected to a 195Km pipeline to Elizabeth Bay where the gas is fed into a jack up barge Nearshore Power Plant (PP) targeting at least 420Mw (phase 1) of power generation, which in turn ties in the generated electricity to an onshore substation and transmission system.

Both domestic (NAMPOWER) and regional markets are being targeted for electricity or gas offtake.

For more information kindly contact the New Ventures Manager.

The Orange Basin Discoveries

Following the 2022 oil and gas discoveries in the ultra-deep-water Orange Basin, NAMCOR E&P and its joint venture (JV) partners of both PEL39 and PEL56 have been advancing preliminary accelerated development efforts through workshopping possible development concepts. The potential development concepts are to be revised, optimized, and firmed up following appraisal results anticipated by end of 2023.

The ownership of PEL 56 comprises TotalEnergies (operator) with 40% working interest (WI), Qatar Energies 30% WI, Impact Oil and Gas 20% WI and NAMCOR 10% carried interest. Subject to positive appraisal outcomes, the Final Investment Decision (FID) of PEL56 is expected to occur in 2025 while First Oil is expected in 2029.

The ownership of PEL39 comprises of Shell Namibia (operator) with 45% WI, Qatar Energy 45% WI and NAMCOR 10% carried interest. Subject to positive appraisal outcomes, FID is expected to occur around Q2 2026 while First Oil is expected in 2030.